personal property tax richmond va due date

Richmond residents will have until July 4 to pay their property taxes without penalty. Depending on your vehicles value you may save up to 150 more because the city is freezing the rate.

Treasurer Chesterfield County Va

Prepayments are accepted if you would like to make payments in advance of the due date for real estate and personal property taxes.

. WDBJ - The Bedford County Board of Supervisors has voted to extend the due date for personal property. Business Personal Property Taxes are billed once a year with a December 5 th due date. Elizabeth City apartments for rent.

Jun 2 2022 1110 AM EDT. Pay Personal Property Taxes in the City of Richmond Virginia using this service. BEDFORD Bedford County residents can expect a 33 rebate on certain personal property taxes for which they were recently billed and the tax payment due date has.

WWBT - As Richmond residents see an increase in their personal property tax bills Richmond City Council has extended the due date for the. Business tangible personal property tax payment. Under Virginia law the government of Richmond.

4 2022 at 1040 AM PDT. At a Special Meeting this week City Council unanimously approved the extension of the 2022 due date for both personal property taxes and machinery tools taxes. Real Estate and Personal Property Prepayments.

Local Taxes Personal property taxes and real estate taxes are local taxes which means theyre administered by cities counties and towns in Virginia. Business Personal Property Registration Form An ANNUAL filing is required on all business personal. WRIC The City of Richmond has extended the due date for personal.

WWBT - As Richmond residents see an increase in their personal property tax bills Richmond City Council has extended the due date for the. 4612 Coronet Ave is a 1800 square foot property with 3 bedrooms and 25 bathrooms. Property Taxes are due once a year in Richmond on the first business day of July.

Tax rates differ depending on where you. Jun 2 2022 1110 AM EDT. Personal Property Taxes are billed once a year with a December 5 th due date.

We estimate that 4612 Coronet Ave would rent between 2088 -. WRIC The City of Richmond has extended the due date for personal property tax to early August. The second due date.

Half of Real Estate Tax Due. There are three basic steps in taxing property ie formulating levy rates assigning property market values and collecting tax revenues. For all due dates if the date falls on a Saturday Sunday or County holiday the due date is extended to the following business day.

Installment bills are due on or before June 5th and on or before. It is estimated that by freezing the rate the city will provide Richmonders more than 8.

Chesterfield Extends Payment Deadline For Personal Property Taxes To July 29

Henrico First To Give Money Back For Personal Property Taxes Under Revised State Law

Virginia S Individual Income Tax Filing And Payment Deadline Is Monday May 2 2022 Virginia Tax

Value Of Used Cars Impacting Personal Property Taxes Vpm

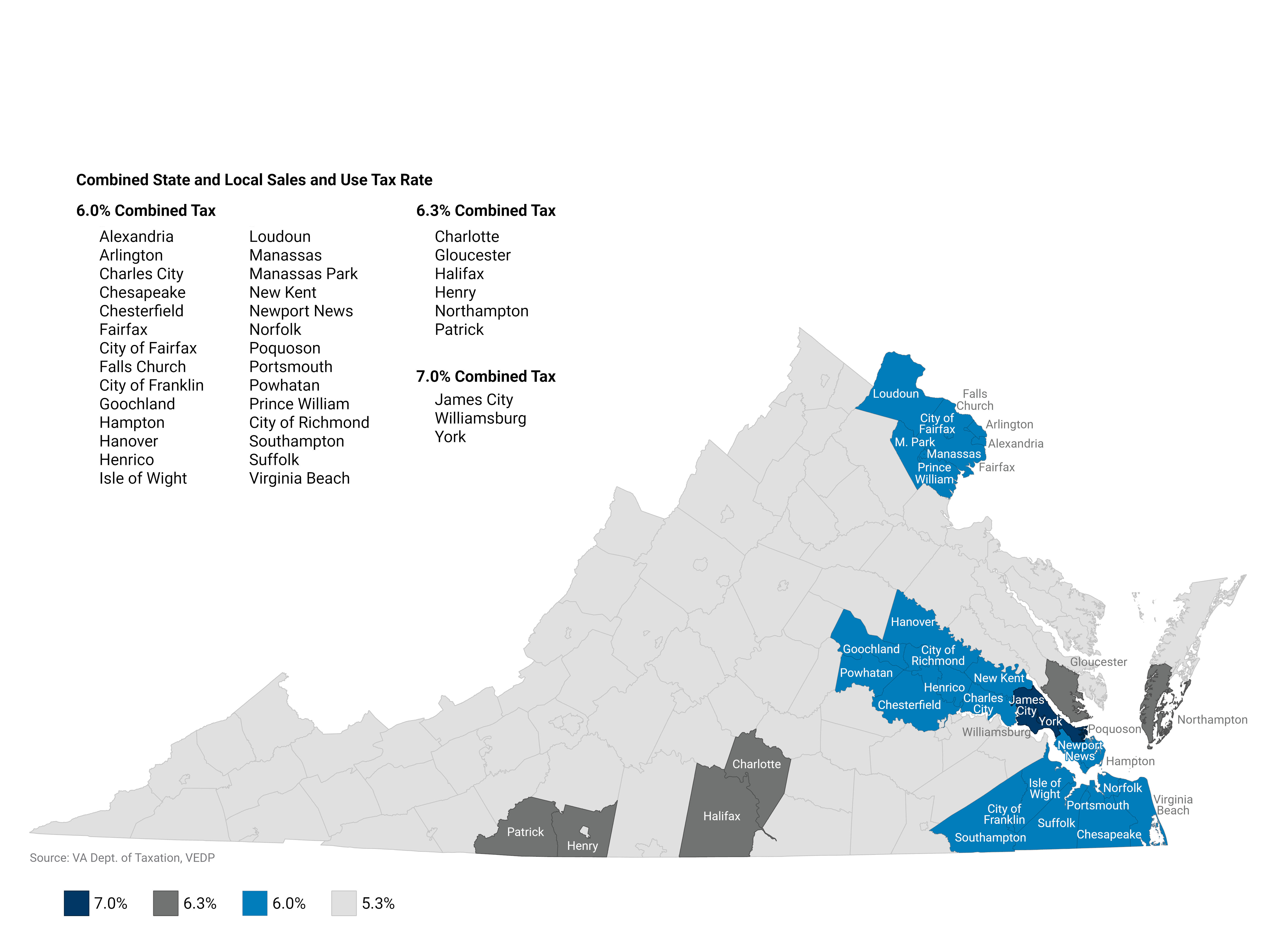

Commercial And Industrial Sales Use Tax Exemption Virginia Economic Development Partnership

Henrico Issues Emergency Ordinance Extending Personal Property Tax Deadline Wric Abc 8news

How To Reduce Virginia Income Tax

Henrico Leaders To Vote On Personal Property Tax Bill Extension

/cloudfront-us-east-1.images.arcpublishing.com/gray/4ASPKZIKKZEKDBCSG3BYAZNXBM.jpg)

Richmond Personal Property Tax Payment Deadline Extended Until Aug 5

Chesterfield Extends Payment Deadline For Personal Property Taxes To July 29

Real Estate Tax Exemption Virginia Department Of Veterans Services

Instructions For Completing Form 770 Virginia Fiduciary Income Tax

/cloudfront-us-east-1.images.arcpublishing.com/gray/4ASPKZIKKZEKDBCSG3BYAZNXBM.jpg)

Richmond Personal Property Tax Payment Deadline Extended Until Aug 5

Retail Sales And Use Tax Virginia Tax

City Of Richmond Extends Personal Property Tax Deadline To August Wric Abc 8news

__primary.jpg)